商品房贷款利率一般为多少

商品房贷款利率一般需要结合您申请的业务品种、信用状况、担保方式等因素进行综合的定价,需经办网点审批后才能确定,但是年龄必须是18-65岁的自然人。

目前人行公布贷款基准年利率为:

1、0-6个月(含6个月),年利率:4.35%;

2、6个月-1年(含1年),年利率:4.35%;

3、1-3年(含3年),年利率:4.75%;

4、3-5年(含5年),年利率:4.75%;

5、5-30年(含30年),年利率:4.90%。

申请商品房贷款的条件必须满足以下四点要求:

1、年龄在18到65周岁的自然人;

2、借款人的实际年龄加贷款申请期限不应超过70岁;

3、具有稳定职业、稳定收入,按期偿付贷款本息的能力;

4、征信良好,无不良记录,贷款用途合法。

房贷商业贷款利率为4.6正常吗

问:房贷商业贷款利率为4.6%正常吗?

答:目前来看,4.6%的利率是房贷商业贷款的正常利率。以下是一些相关信息。

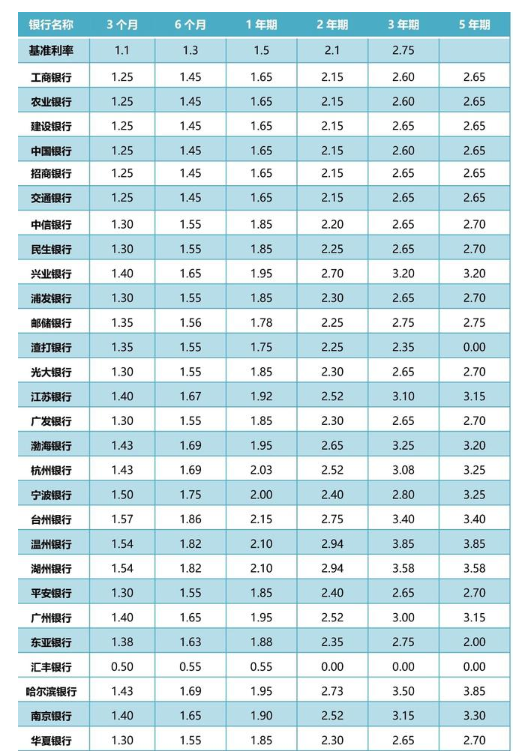

首先,中国人民银行最近发布的数据显示,该行调查的535家商业银行家喻户晓的贷款基准利率未发生变化,彰显了稳健的货币政策取向和市场基准利率作用的深入实施。这也说明了房贷商业贷款利率稳定的趋势。

其次,各家商业银行的房贷商业贷款利率主要都是在4.5%到5.5%之间波动。而在严格的监管和政策导向下,商业银行的基准利率往往要比最上限的利率低。

最后,房贷商业贷款利率的高低不仅受到市场供需和货币政策的影响,还受到借款人的信用等因素的影响。不同银行、不同地区、不同客户信用状况,对房贷商业贷款利率的要求和标准也不同。

【英文介绍/For English】:

The commercial housing loan interest rate generally needs to be comprehensively priced based on factors such as the type of business you apply for, credit status, guarantee method, etc., and can only be determined after approval by the branch office, but the age must be a natural person aged 18-65.

At present, the People's Bank of China announces the benchmark annual interest rate of loans as follows:

1. 0-6 months (including 6 months), annual interest rate: 4.35%;

2. 6 months to 1 year (including 1 year), annual interest rate: 4.35%;

3. 1-3 years (including 3 years), annual interest rate: 4.75%;

4. 3-5 years (including 5 years), annual interest rate: 4.75%;

5. 5-30 years (including 30 years), annual interest rate: 4.90%.

The conditions for applying for a commercial housing loan must meet the following four requirements:

1. Natural persons aged 18 to 65;

2. The actual age of the borrower plus the loan application period should not exceed 70 years old;

3. Have a stable job, stable income, and the ability to repay the principal and interest of the loan on schedule;

4. Good credit information, no bad records, and legal loan purposes.

房贷商业贷款利率为4.6正常吗,请问商品房贷款利率一般为多少?相关文章: